Bhaskar Explainer: GST Council can consider bringing petrol-diesel under GST, how would you benefit if that happened? How much damage to the government? Know everything

The GST Council is meeting in Lucknow tomorrow. It is speculated that the meeting may consider bringing petroleum products under GST. This is the first physical meeting of the GST Council since the Corona epidemic. The 45th meeting of the GST Council will be chaired by Finance Minister Nirmala Sitharaman.

In June, the Kerala High Court urged the council to consider bringing petroleum products under GST. Following the High Court's insistence, the GST group of ministers has prepared a proposal. If the group of ministers agrees, the proposal will be submitted to the GST Council. The council will then decide on it what to do next .

Understand, how are petrol-diesel prices determined at present? What will be the impact of GST on the Center, the state and the people? What kind of system can be adopted if petroleum products are covered under GST? And what are the obstacles in implementing this decision ...

How are petrol-diesel prices determined now?

Until June 2010, the government used to fix the price of petrol and it could be changed every 15 days, but after June 26, 2010, the government has left the pricing of petrol to the oil companies.

Thus, the price of diesel was also fixed by the government till October 2014, but from October 19, 2014, the government also handed over the work to the oil companies.

This means that the government has no control over the pricing of petroleum products. This is what oil marketing companies do. Oil companies determine the price of petrol-diesel on a daily basis by considering the price of crude oil in the international market, exchange rate, tax, cost of transportation of petrol-diesel and many other things.

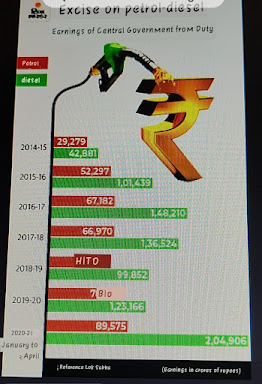

Fear of reduction in revenue The biggest reason for not bringing petrol-diesel under GST

One big reason is the lack of will at the state governments and the center. In fact, bringing petrol-diesel under GST will cost governments a loss of revenue and the government does not want to change any of its sources of revenue.

Before determining the GST rate on any goods or services, it is necessary to look at how much tax is being levied on it by the Center and the state together in the present system. In technical language it is called Revenue Neutral Rate (RNR). It is calculated so that the Center and the states do not have to suffer any loss. This is also a major hurdle in not implementing petrol-diesel GST.

No comments:

Post a Comment